As of November 1, 2011, it got just a little bit tougher to qualify to file a Chapter 7 Bankruptcy here in Colorado Springs and throughout the rest of Colorado. That’s because the median income here in Colorado once again dropped.

As of November 1, 2011, it got just a little bit tougher to qualify to file a Chapter 7 Bankruptcy here in Colorado Springs and throughout the rest of Colorado. That’s because the median income here in Colorado once again dropped.

So why should that make it tougher? Well back in 2005 Congress decided that too many people were filing Chapter 7 bankruptcy cases and they changed the law to make it more difficult. Their intent was to make more people ineligible to file a Chapter 7 and instead force them into filing a Chapter 13, where the creditors end up receiving money from the bankruptcy estate.

Every now and again, the office of the U.S. Trustee looks to the U.S. Census Bureau to figure out what the median income is in each state, according to household sizes. If your income is less than the median income for a household of your size in Colorado, you will typically be allowed to file a Chapter 7 bankruptcy case, no questions asked.

So what exactly is the “median” income? The median income is the amount at which half of the households make more, and half of the households make less.

If your income is above the median income for a household of your size you will not be “automatically” allowed to file a Chapter 7 bankruptcy case. In order to see if you qualify to file a Chapter 7, your attorney will have to perform a complicated set of calculations known as the “Means Test“. The Means Test takes into consideration typical household budget items like rent and groceries to determine whether or not allowing you to file a Chapter 7 case would be an abuse of the bankruptcy system. It also looks more closely at where you actually live, since it may be more or less expensive to live in Colorado Springs than other parts of the state.

Of course it’s much easier if your income is less than the median in your state. Then there’s no need to complete the means test.

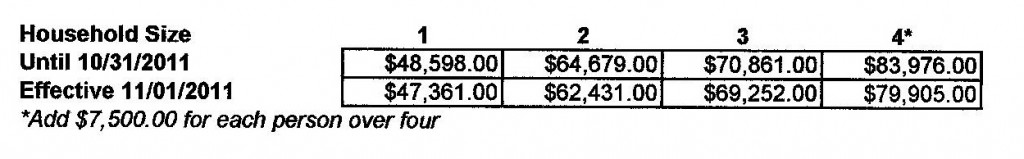

So, how much did the median change on November 1st?

This table shows the differences effective November 1, 2011:

As you can see the median income in the state of Colorado continues to drop.

There’s something else that you need to consider. In order to determine the amount of your income, we look at the six-month period before the month that you are going to file your case. We take the gross amount of income that you received during that six-month period and double it to determine the the annual figure. Some income is not included in the calculation, however, most notably Social Security benefits.

As you can imagine this can be pretty complicated, since some things that you would not consider to be income might be considered to be income and other things that you think might be income might not be. The best thing to do is to contact a competent bankruptcy attorney in order to review your specific situation.

That way you’ll know if you will be eligible to file a Chapter 7 bankruptcy case using the new median income guidelines.