The next question that must be answered before you can file your bankruptcy case is: “How long have you lived in your current state?” Under the bankruptcy venue law, you must have lived in your current state for at least “the one hundred and eighty days immediately preceding” the filing of your case, or “for a longer portion of such one-hundred-and-eighty-day period”. What does this mean? It means that you must have lived in your current state for at least 91 days in order to file your case in that state.

The next question that must be answered before you can file your bankruptcy case is: “How long have you lived in your current state?” Under the bankruptcy venue law, you must have lived in your current state for at least “the one hundred and eighty days immediately preceding” the filing of your case, or “for a longer portion of such one-hundred-and-eighty-day period”. What does this mean? It means that you must have lived in your current state for at least 91 days in order to file your case in that state.

Another factor to consider is the exemptions you can receive for your property. In general, if your property is exempt, it cannot be taken from you in order to pay any of your debts. To complicate matters, each state’s rules regarding which property is exempt are different from other states. In addition, there are federal exemptions which may also be available to you. The state exemption law that will apply to you is the state where you have lived for the 730 days (~2 years) before you file your case.

This can get pretty complicated when you haven’t lived in your current state for at least 730 days. In that case, you have to use the exemptions offered by the state where you lived for the 180 day period immediately before the 730 day period, in other words, for the 731st through 910th day before you file. (It’s probably easier to figure it as the approximately six month period before the two year period). If you lived in more than one state during that 180 day (~ six month) period, then whichever state you lived in for the longer portion is the state whose exemptions you can claim. It gets even more complicated when your former state requires that you be a current resident in order to receive its exemptions. In that case, you can’t get the exemptions form your current state or your former state. So, you get the federal exemptions!

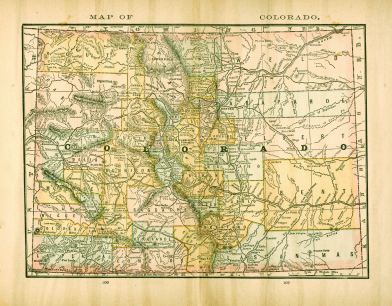

Why is this important? Well, for example, in Colorado, you get an exemption for your car up to $5,000. In Florida, you only get a $1,000 exemption for your car. So, if you have a car worth $4,500 that you own free and clear, in Colorado, you get to keep it. In Florida, maybe not.

If you have questions regarding which exemptions apply to you, check with your local bankruptcy attorney. Selecting the right exemptions can have a serious effect on which property you may keep when you file for bankruptcy.

Next post: What stuff can you keep in Colorado?